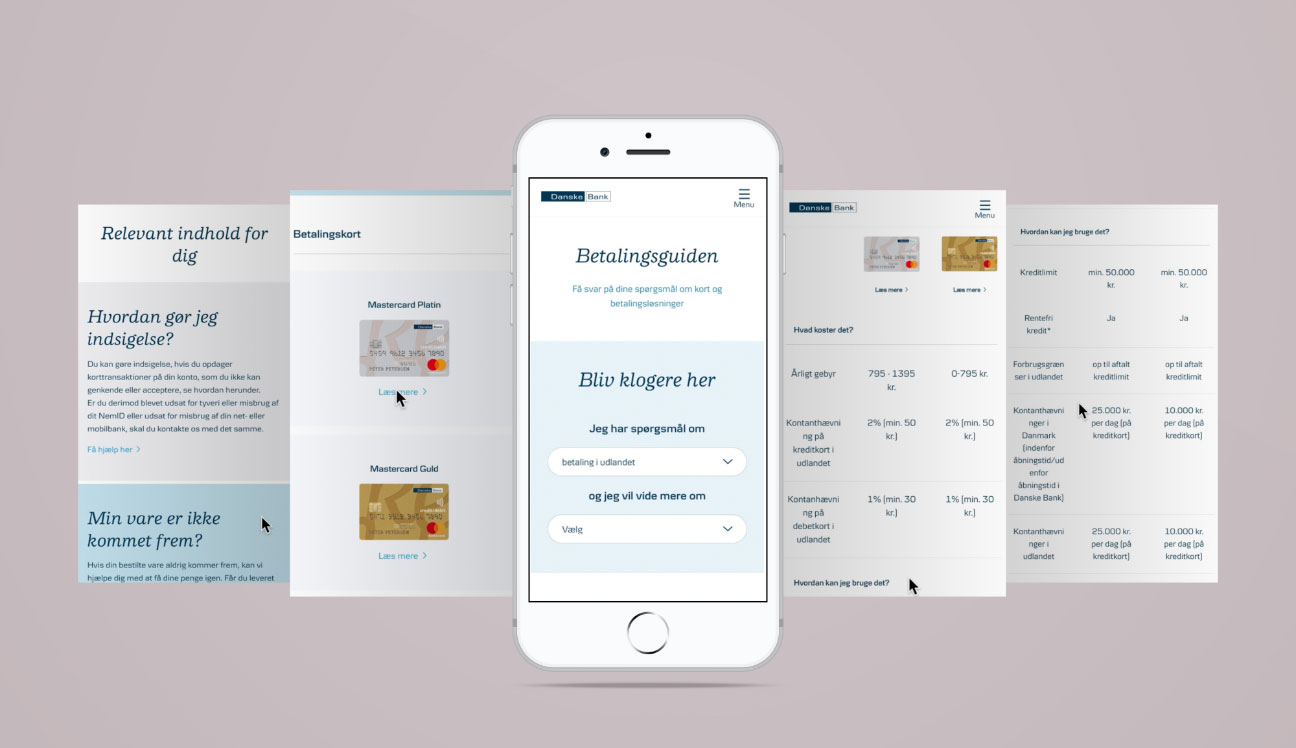

Digital payment guide

A payment guide focusing on customer needs

The challenge

Danske Bank has revolutionised how Danes transfer money with MobilePay, but it takes more to win customers back. The bank needs to regain trust by offering great service and putting customers first. A key to this is creating a digital presence that feels personal.

In this light, Danske Bank faced a challenge. The bank’s guide to cards and payment solutions was very product-oriented and didn’t focus on the customer’s needs. So, a lot of customers called the bank for help and information.

Therefore, Danske Bank wanted to create a user-friendly digital tool that makes it easy to find answers about cards and payment solutions. So that customers can easily choose the right solution based on their needs and situation.

The solution

Betalingsguiden (The Payment Guide) puts customer needs at the centre stage by asking a few simple questions. Does the customer have a real problem? Can I solve the problem and if so, what impact will it have? This way, customer feed directly into the decision-making and selling process.

Part of our customer-centric approach is not just offering Danske Bank’s own products, but also to present other solutions. Such as MobilePay, Google Pay, Apple Pay and smartwatches.

The key benefit

Betalingsguiden enables customers to understand various payment solutions so that they can choose and order the right solution for them.

Not to mention the fact that great personal service creates loyal customers – and loyal customers tend to hang around for many years.

The success criteria

The new tool is yet to be released on Danske Bank’s website, but the goals are clear. The new tool must increase Mastercard applications, activations and transactions/usage by educating customers in card benefits.

Also, Betalingsguiden should lead to fewer calls regarding payment solutions and cards.

Copy Writer: tnreklame.dk

Design & Development: https://kruso.dk